Basics

Standard Statements provide an exciting way to manage Statements that is accurate both up to the day and historically. How do we accomplish this? A combination of a nightly routine (providing day-to-day accuracy) and archiving (locking in historical accuracy), ensuring your Donor's Statements are accurate at literally any time. Even better? Donors can view their Statements using the My Contribution Statements Widget. It's a win-win-win!

- Statements live on their own, dedicated Page that is accessible at any time.

- Unarchived Statements are updated nightly.

- Statements for previous years enter an archived state, which prevents changes and ensures historical accuracy.

- Each batched Donation is now associated directly with a single Statement.

- The all-new powerful and flexible "Donor Standard Statement" Report is a single Report formatted according to preferences you set on the Accounting Company Record.

- Authenticated Users can view their Statement via the My Contribution Statements Widget.

Standard Statements are just that, Standard. If you'd like to see a change to the Standard Statement, add it as a suggestion to the Idea Board and whip up those votes! Note: Standard Statements are not customizable via Professional Services.

Terminology

- Statement Record: Dedicated page for viewing and managing Statement settings.

- Statement Donors: Dedicated subpage displaying Donor and Statement detail.

- Standard Statement: The technology, configuration, and method of generating these Donor Statements.

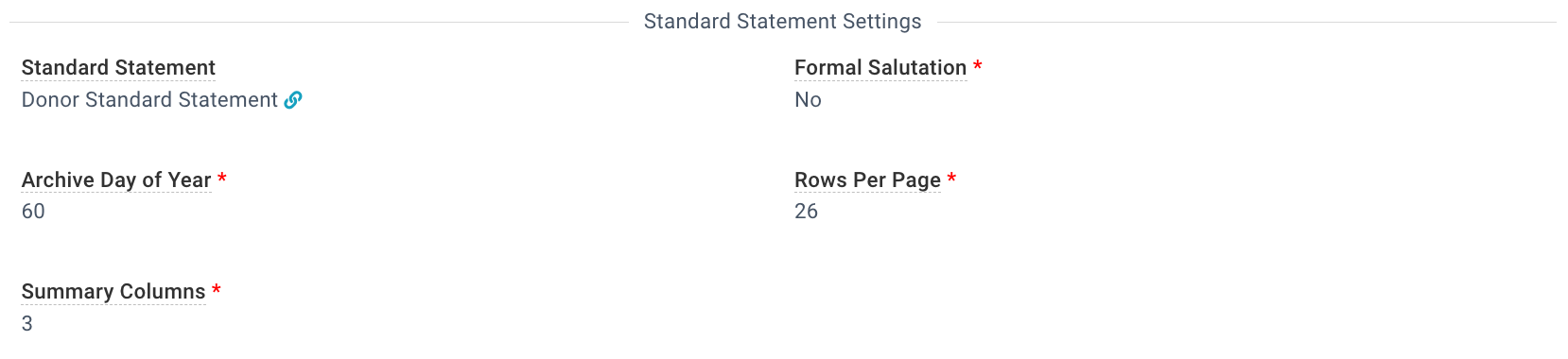

- Standard Statements Settings: New section of Accounting Company controlling Standard Statement archiving and reporting behavior.

- Statement Maintenance Routine: Nightly routine that analyzes and updates various statement related information.

- Statement Maintenance Required Process: Process that can be manually triggered when maintenance is required to update unarchived Statements.

Additional Resources

Configuration

If you're not using Standard Statements, here's everything you need to know to get it up and running. Need help?

Support is just a click away!

- Review your Accounting Company to make sure it is configured as described below. Note: Be sure to set the Standard Statement field to Donor Standard Statement.

- Review your Programs and their Statement Headers. Pro Tip: The Stewardship Info views are will be helpful here!

- Turn on the Statement Generator Webhook.

- Administration > Webhooks.

- Open the Statement Generator Webhook.

- Edit.

- Set the following:

- Active = Yes

- Trigger on Update = Yes

- Save.

Ensuring Accuracy

Routine & Process

Current, unarchived Statements are managed via a nightly routine (Statement Maintenance routine) that associates Donations with the correct statement, populates the "Statement Description," associates Donors with the correct Statement, and updates the Salutation as needed.

The Statement Maintenance Required process updates the same information as the Statement Maintenance routine. You can manually trigger this process by updating the Accounting Company record.

See Standard Statements - Routine & Process to read all about it and learn all the details.

Archiving

Statements are automatically archived and can be archived manually (either as a single record or via mass assign). This ensures accuracy for past statements as data (aging out, marital status changes, etc.) changes over time. Want to do

an archiving deep dive? See Standard Statements - Archiving!

Note: If certain corrections are requested after archival, Statements may be unarchived (Archived = False). This is not true of all corrections scenarios and should be employed only when necessary. See

Archiving for more information about how to correct archived statements. Spoiler alert—unarchiving isn't always necessary!

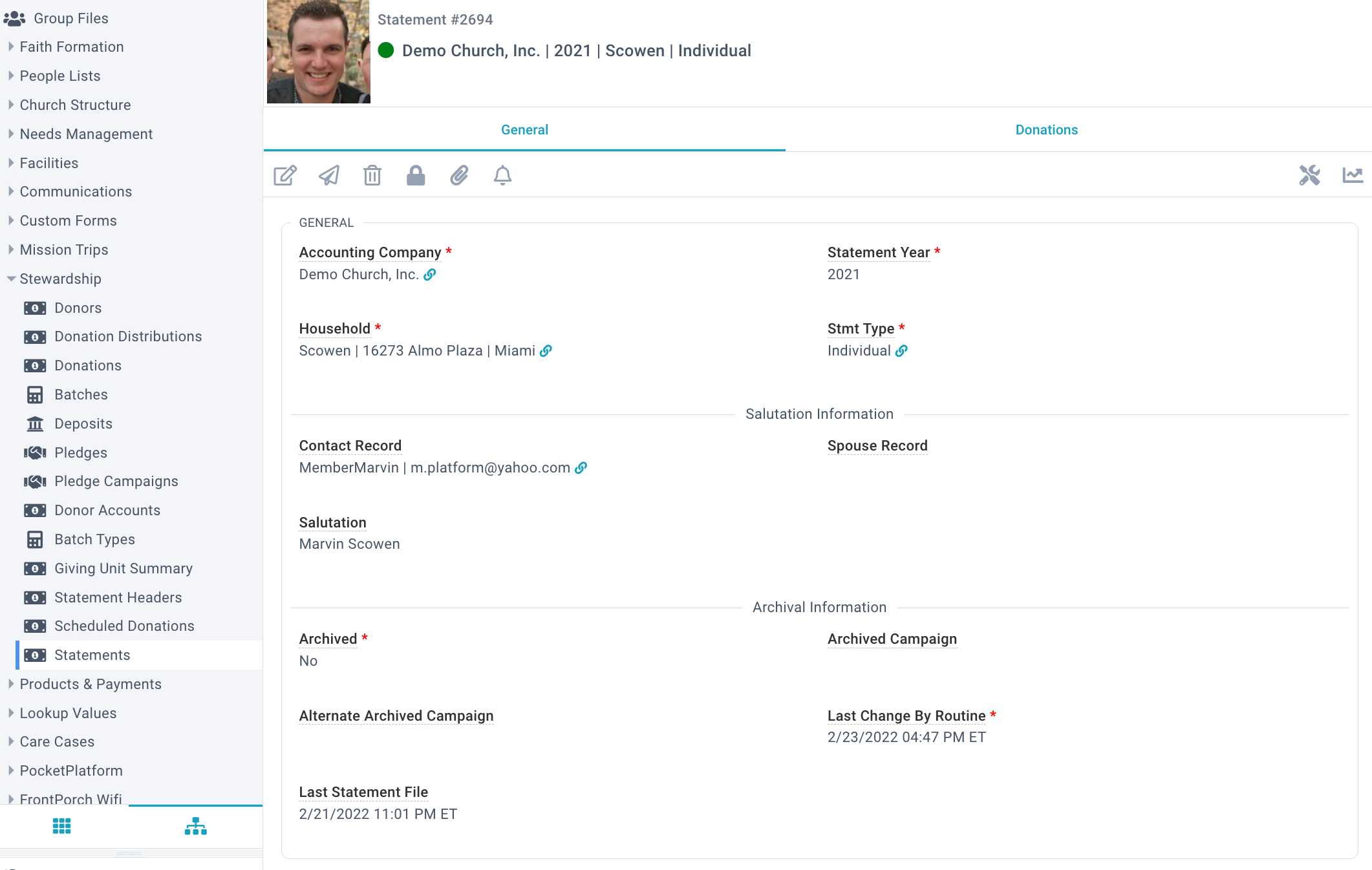

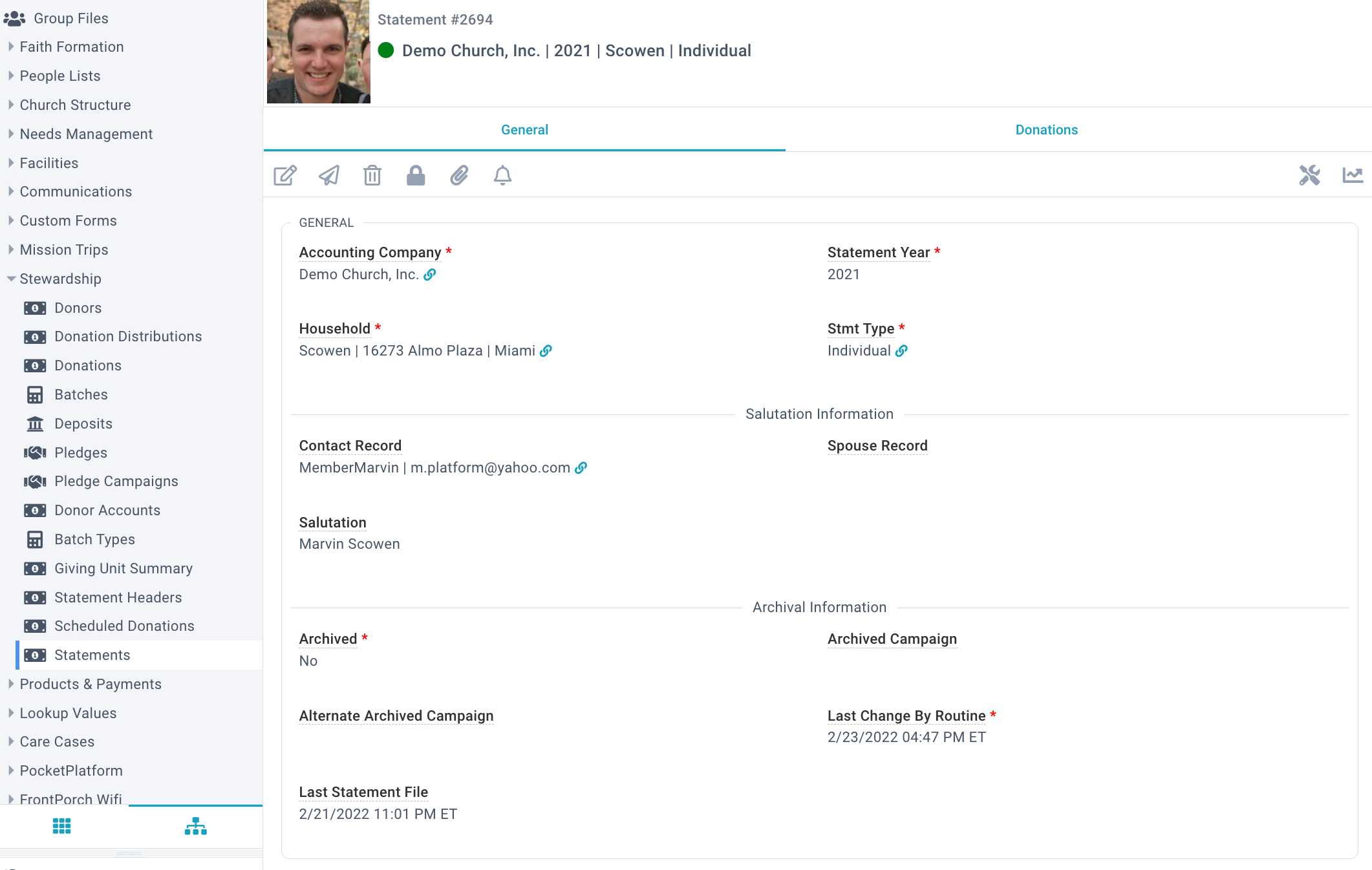

Statements Page

A dedicated Statements page for viewing Statement details will be added on deployment and includes both a Donations and a Donors sub-pages.

To be associated with a statement and show up on the Statements page, donations must be: 1) in a batch;

2) associated with a tax-deductible Program via a Distribution;

3) and have a Donation Date prior to the Accounting Companies 'Statement Cutoff Date.

- Accounting Company: Program's Accounting Company.

- Year: Calendar year the donation was made.

- Household: Contact's Household.

- Statement Type: set on Contact’s Donor Record.

- Contact Record: Donor's Contact Record.

- Spouse Record: Contact's Spouse, if known and the Donor's Statement Type is Family. If the Statement Type is Individual, each spouse will have their own statement. Note: A Spouse does not need to have a Donor Record to appear under 'Spouse' or be included in the 'Salutation.' But a Spouse will only appear in the Donors

sub-page if they have a Donor Record.

- Salutation: Displays the Contact and, if known, the Spouse. This will typically display the male Head of Household followed by the female. But if the female is the original Donor and appears as the Contact, this may be

reversed.

- If the Accounting Company's 'Formal Salutation' field is false, Nicknames will be used.

- If the Accounting Company's 'Formal Salutation' field is true, the Contact's First Name and Prefixes (if populated) will be used.

- Archived Information: Populated when Archive = True. 'Last Change by Routine' will always show the most recent change to the Statement itself or any Record associated with the Statement (for example, a

new Donation associated by nightly routine).

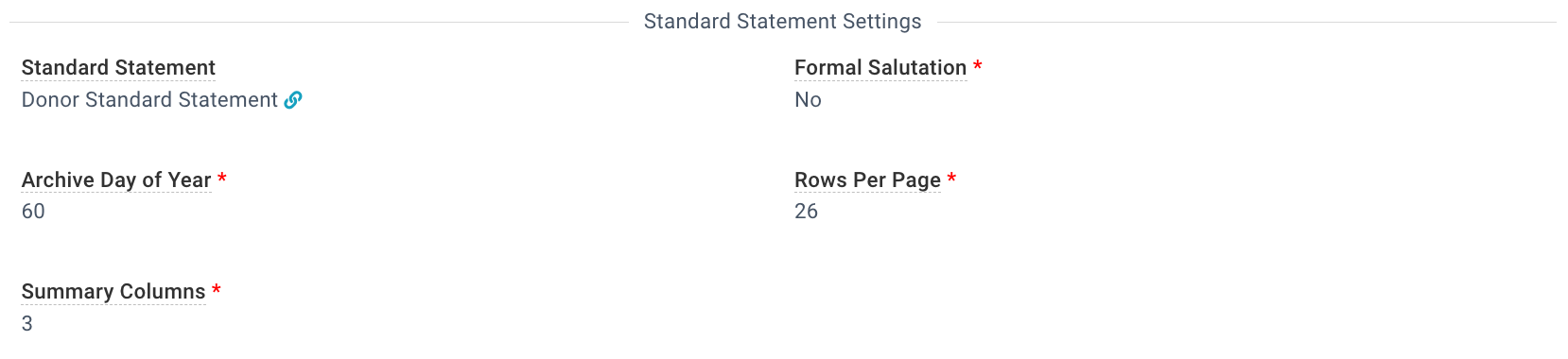

Accounting Companies

Accounting Companies has been extended to include Standard Statement Settings. If a Donor has made Donations to more than one Accounting Company, multiple Statements

will be generated for the same calendar year.

- Standard Statement: Set to Donor Standard Statement.

- Rows Per Page: Number of donation rows that can fit safely on a single contribution statement page. Twenty-six rows are recommended.

- Summary Columns: Number of columns (1-6) on your statement that will summarize Statement Headers. For example, if set to 4, the first 3 Statement Headers will be explicitly listed, and Donations to Programs under

those headers will be summarized in their respective columns. The final column will be "Other".

- Formal Salutation: If true, the greeting will appear above the address block of the Donor Statements using the Donor's title and First Name (rather than Nickname).

- Archive Day of Year: Day of the year when the prior year Statements will be automatically archived. Must be between 46 (Feb 15) and 121 (April 30th except for Leap Year!). Default is 46.

- Default Congregation: Enables the Global Filter on the Statements page. Note: Leave this option blank except where the Accounting Company has only a single Congregation.

This primarily applies to Diocese (see below).

- Alternate Pledge Campaign: Second, an additional campaign for which a donor with a pledge should see a pledge recap, including their pledge balance in the top corner of their donor statement.

If you are a Diocese: Diocese have a 1:1 ratio of Accounting Companies and Parishes. In this case—and only in this case—the Congregation field should be populated on the Accounting Company

record.

If you are NOT a Diocese: Do

not populate the Congregation field on the Accounting Company record.

Note: If you assign

Global Filters to your Accounting Staff, you

must also assign them the "*Not Assigned" Global Filter.

If you don't, they won't be able to see any Statements because, for non-Diocese churches, Statements are not be assigned to a Congregation.

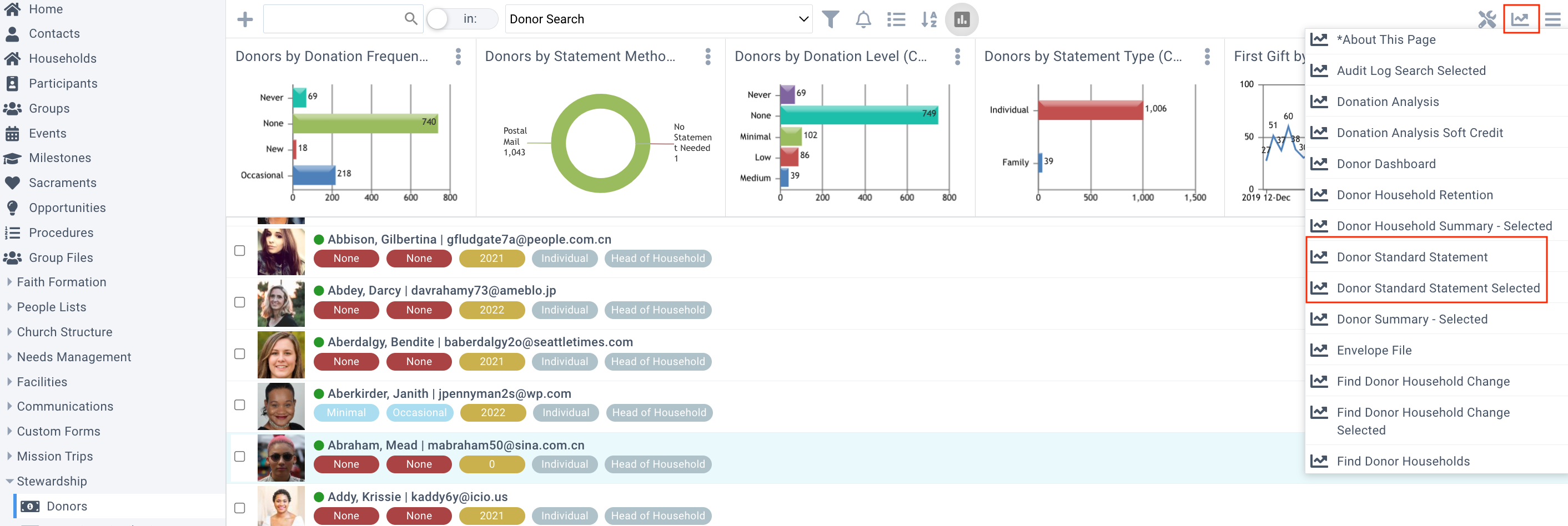

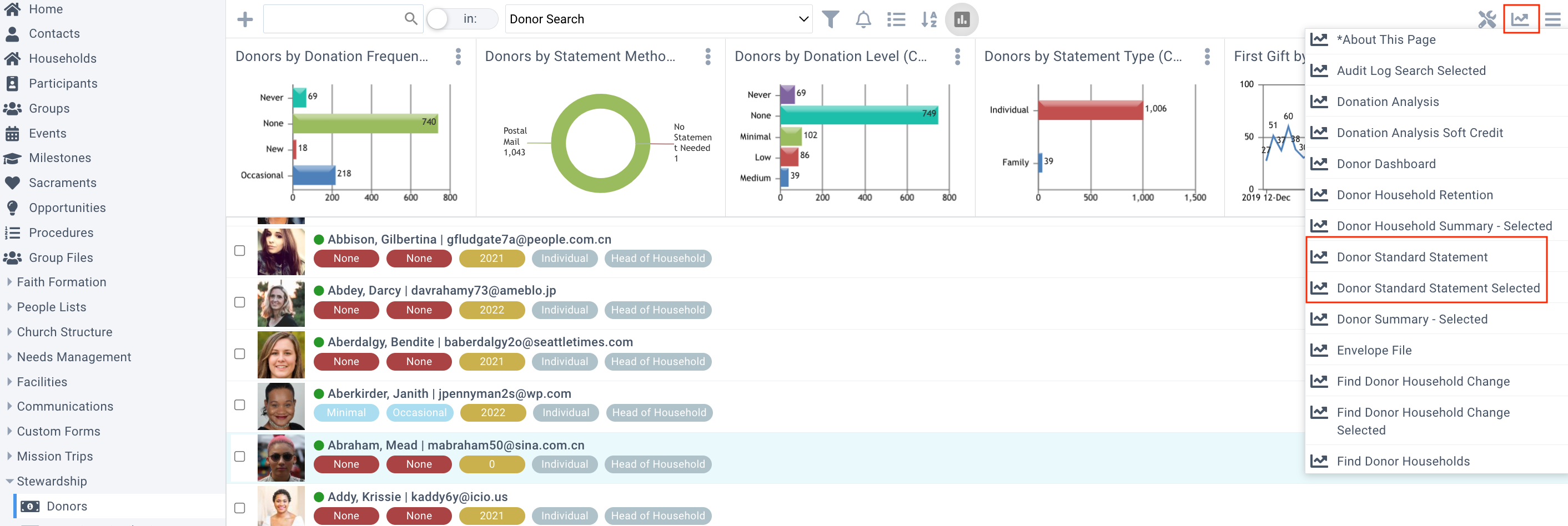

Accounting Company Configuration: The Accounting Company Statement Cutoff Date is a date/time field used when generating all statements for the Accounting Company, including those available on the My Contribution Statement page and Standard Statements. Standard Statements considers both the date and time when determining the statement cutoff date. Want to include all donations made through December 31? Set the Statement Cutoff Date to 12/31/[year] 11:59pm. New Reports

The Donor Standard Statement (All Records

and Selected) is available from Accounting Companies, Donors, and Statements pages.

The reports are rendered according to 1) configurable parameters set in the Report, and 2) values set on Accounting Companies (see above). See Donor Standard Statement to read up on setting up your configurable and Accounting Companies parameters.

And finally...

- Using the My Contribution Statement Widget, authenticated Users can view and download PDFs of their giving statements and update their Statement delivery method.

- Statements are generated and kept in an archived state, so any Contact who has ever Donated must have a Household. This includes Deceased Contacts. If the Contact does not have a Household, one will be created for them via the routine.

Remember this when using the Deceased Persons Tool.

- Fields that may be frequently affected by the routine are not Audit Logged:

- Donations

- Donation Distributions

- Statements

- Periphery items affected by the routine are Audit Logged:

- For customers onboarding after December 2020, Standard Statements will be the one statement to rule them. No other Statement Reports will be deployed for customers onboarding after December 2020.